Market Manipulation

Not a guide...

This blog explores how even some of India's largest companies, boasting market capitalisations around ₹50,000 crores, can be susceptible to manipulation. We'll delve into two specific examples: ITI and FACT, to illustrate this phenomenon.

ITI: A Tale of Dilution

ITI, a prominent player in the telecommunications sector, grapples with significant challenges. The company has consistently reported losses over the past decade, indicating a persistent struggle for profitability. This financial distress is compounded by a substantial dilution of its equity – the number of shares outstanding has skyrocketed from approximately 29 crores in 2015 to 96 crores today, representing a staggering 231% increase.

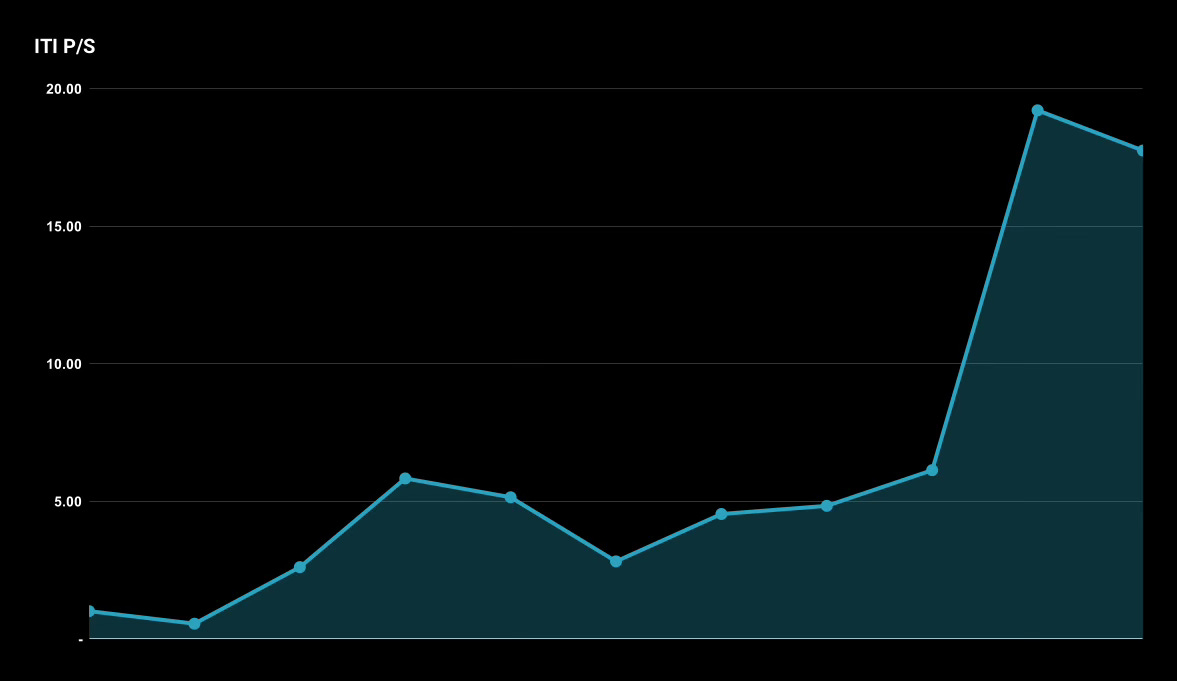

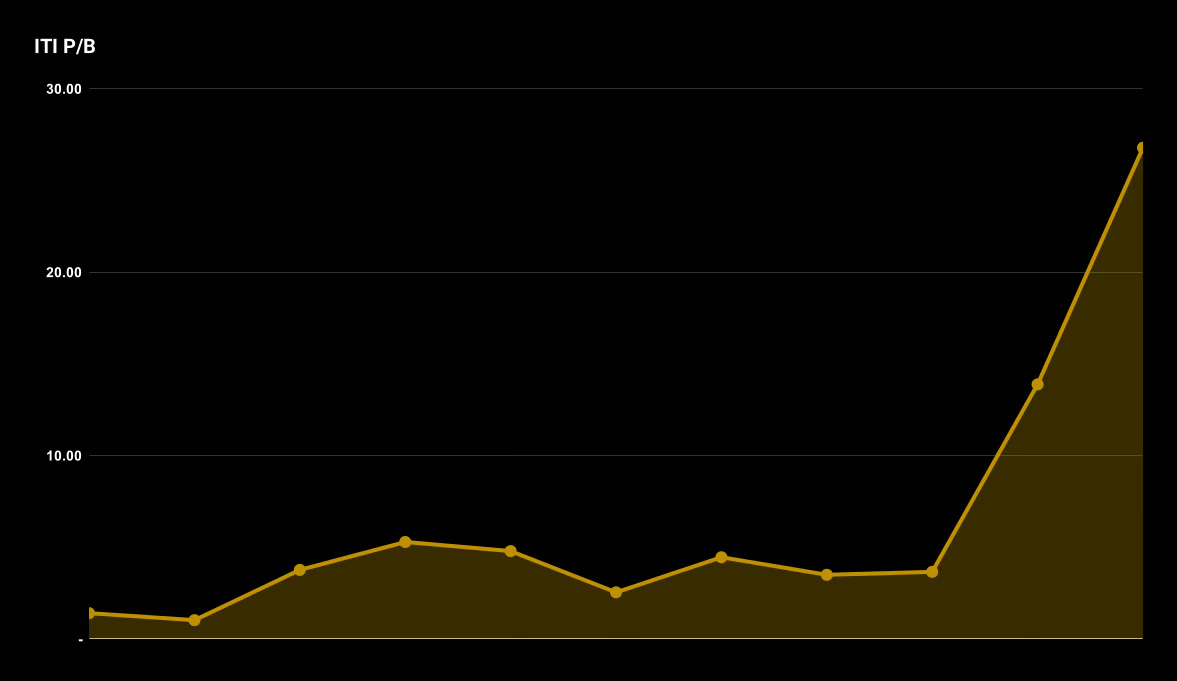

Paradoxically, ITI's valuation metrics, such as price to sales and price to book ratios, have surged over the past decade.

While recent quarters witnessed great revenue growth (231% in June 2023 and 312% in September 2023), the company remains unprofitable

Transparency remains a serious concern. ITI refrains from releasing investor presentations or conducting conference calls to provide shareholders with crucial updates on its performance and direction. Furthermore, its order book, at approximately ₹11,800 crores, appears alarmingly low compared to its colossal market capitalization, suggesting investors may be placing undue faith in the company despite its weak fundamentals.

Over the past decade, ITI's sales have grown at a depressing 6% CAGR. Yet, its stock price has delivered a remarkable 28% annualised return, significantly outpacing its revenue growth.

The company has experienced extreme volatility in operating margins, fluctuating wildly between -37% and +7% over the past decade. This volatility underscores the fragility of its business, which is highly susceptible to external shocks. ITI's inability to consistently generate profits, coupled with sluggish sales growth beyond the recent quarters, casts a shadow over its long-term viability.

FACT: Fertilising a Mirage

Fertilisers and Chemicals Travancore (FACT), operating in the fertilisers and chemicals sector, faces similar challenges. Its business model is characterised by a lack of pricing power and a competitive disadvantage as it is not even among the lowest-cost producers.

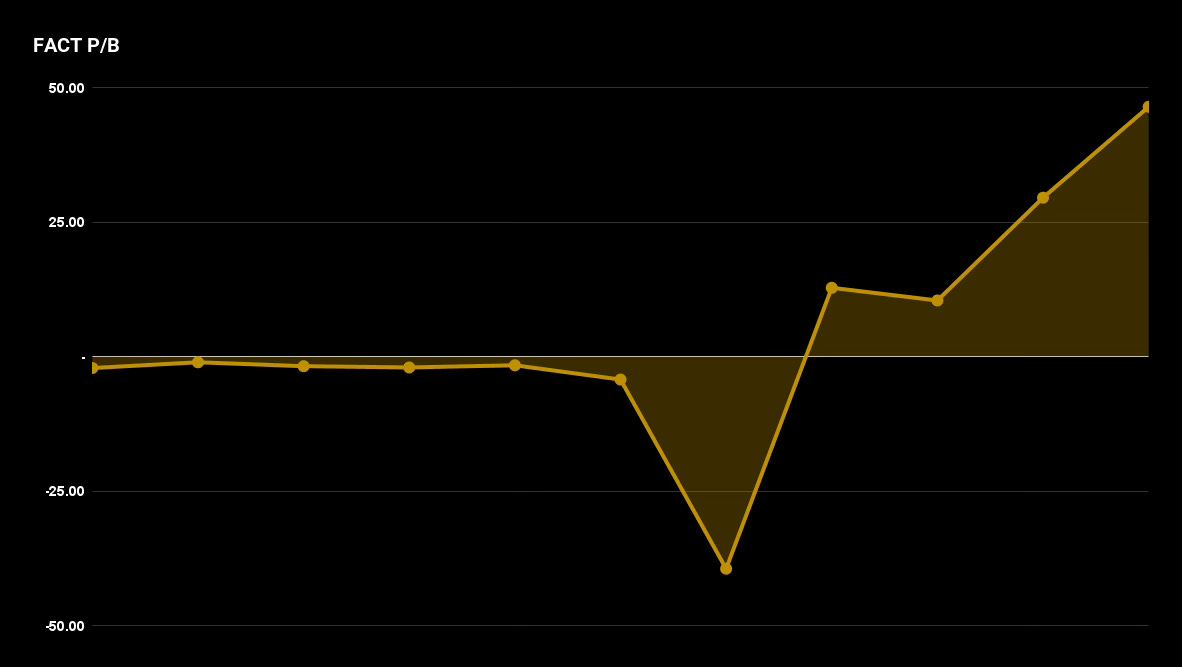

FACT's financial struggles are well-documented. The company reported losses from 2013 to 2018 and has once again slipped into losses in FY24. Its operating margins have remained volatile, ranging from -13% to +17% over the past decade, reflecting its inability to consistently deliver profitability.

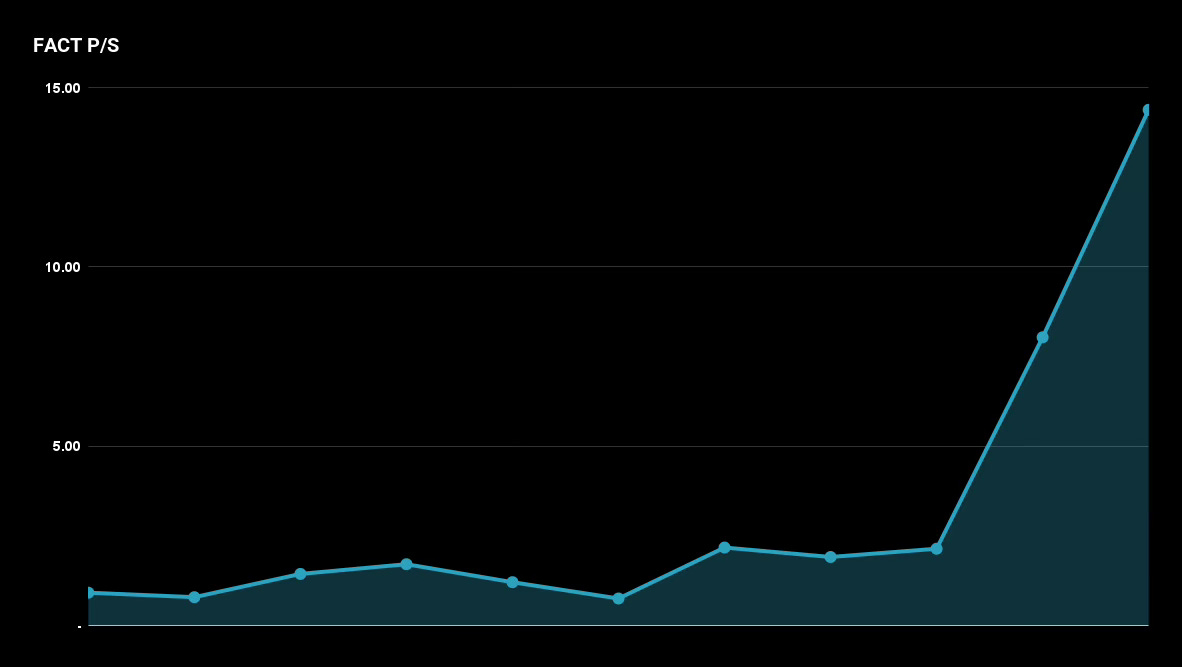

Despite these challenges, FACT's valuation metrics have witnessed a remarkable surge. After an extended period of negative book value, leading to a negative price to book ratio, the company now boasts an astonishing price to book ratio of 46.4. Similarly, its price to sales ratio has significantly increased over the past decade.

While FACT's annual sales have grown at 9% CAGR over the past decade, its stock price has delivered an astounding 40% annualised return during the same period. This significant disconnect between fundamentals and stock performance warrants serious scrutiny. Even during periods of favorable conditions, such as strong monsoons in India, FACT has struggled to significantly improve its margins. This raises concerns about the company's ability to navigate challenging market conditions and sustain profitability.

How Are These Stocks Manipulated?

Despite their weak fundamentals, both ITI and FACT have managed to maintain their stock prices. This can be attributed to their unique shareholding structures and the limited availability of shares for public trading.

The government holds a 90% stake in both companies. The Special National Investment Fund (SNIF) which channelises funds from PSEs towards social causes also holds substantial stakes in both companies, 7.9% in ITI and 8.56% in FACT. Consequently, only a minuscule fraction of shares is available for public ownership. The public float for ITI stands at a mere 1.99%, while for FACT, it's even lower at 0.89%. At current market prices, this translates to a meager ₹847 crores worth of shares available for trading in ITI and ₹539 crores in FACT.

This low public float renders these stocks highly vulnerable to manipulation. ‘The Operator’ probably acquired these shares at a lower cost. For instance, yesterday on 10th January, 405.9k shares of ITI were traded, amounting to a traded value of ₹1,800 crores – more than double the entire publicly traded float. Furthermore, the delivery volume was negligible at just 4%, suggesting potential circular trading activity.

FACT exhibits a similar pattern. On the same trading day, 304k shares of FACT were traded, resulting in a traded value of ₹28 crores. While this figure may seem less concerning, examining periods of significant stock price increases reveals a different story. For instance, on 20th June 2024, trading volumes for FACT surged to 15856k shares, resulting in a traded value of approximately ₹1,700 crores approximately 70% higher than the public float at that time.

Final Thoughts

ITI and FACT serve as stark reminders of the potential for manipulation, even among large-cap companies. Despite their weak financial fundamentals, both have experienced significant stock price appreciation, far exceeding their intrinsic value. This phenomenon can be largely attributed to their low public float, which makes them highly vulnerable to manipulation.

Investors are strongly advised to exercise extreme caution when considering investments in such companies. The market is filled with companies that, while differing in specifics, share similar texture.

It is important to note that these stocks could face acute downside as they eventually revert to their intrinsic value. Be wary of such stocks.

Risk comes from not knowing what you’re doing.

– Warren Buffett

NOTE: The calculations are approximations.